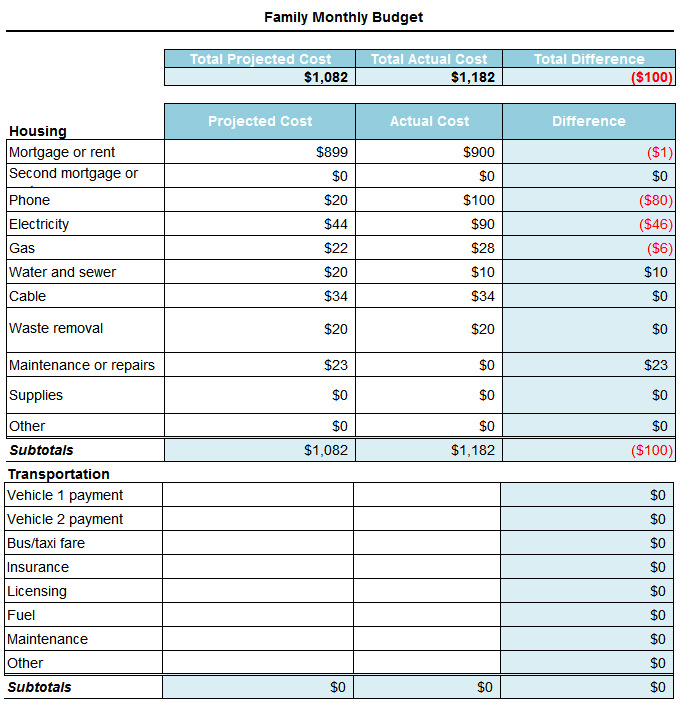

We have designed and created a free monthly budget tracker for all Money Nerd readers. Your expenses could change, and so could your employment income, so it is essential to regularly update your monthly budget for accurate results. They make their monthly budget, stick it on the fridge and then expect everything to stay the same throughout the months. The biggest mistake people make when using a monthly budget is that they do not update it.

You can download more detailed and informative monthly budgets for free – like the one we have made for all our readers. This is the most basic form of a monthly budget. Don’t forget the smaller things people tend to forget, like haircuts or regular social occasions. And then write down your monthly expenses, such as bills, rent, groceries and memberships. For most people, this will just be employment income. All you need to do is write down the amount of money you receive each month. How Do You Write a Monthly Budget?Ĭreating a monthly budget is quite simple. But it is one way to analyse a monthly budget if you are using a budget just for saving purposes. If you have big debts or are financially struggling, you probably won’t be able to use this rule right now. Of course, not everyone can stick to the 50/30/20 rule. She stated that everyone should spend 50% of their income on necessities, 30% on things you want and 20% should be saved. This is a spending theory made famous by an American politician called Elizabeth Warren.

Some people use a monthly budget tool to stick to the 50/30/20 rule. Debt Relief Orders Explained and 2023 Criteria.

0 kommentar(er)

0 kommentar(er)